massachusetts estate tax return due date

Because this is tax there are exceptions. When filing estate taxes IRS Form 706 is due within nine months of a decedents date of death but filing Form 4768 automatically grants a six-month extension.

Should You Elect The Alternate Valuation Date For Estate Tax

If youre responsible for the estate of someone who died you may need to file an estate tax return.

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

. The full amount of tax due for the estate tax return must generally be paid within nine months after the date of the decedents death. 416 Name of decedent Date of death mmddyyyy Social Security number 333 Street address at time of death CityTown State Zip County of probate court Casedocket number Name of executorpersonal representative Designation Phone Street address CityTown State Zip Name of attorneys if any representing estate. The final return for Massachusetts will cover the income received by the decedent up until date of death.

File a 2021 calendar year return Form M-990T and pay any tax interest and penalties due. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. For other forms in the Form 706 series and for Forms 8892 and 8855 see the.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. These are still due April 20 2021. Unlike the federal estate tax which taxes only the amount over the exemption 117 million for 2021 once a Massachusetts estate is valued over the million-dollar mark the entire estate becomes subject to estate tax starting at dollar one.

Late Filing Penalty - 1 percent per month or fraction thereof to a maximum of 25 percent of the tax as finally determined to be due. The following is the review of Massachusetts estate tax returns. This due date applies only if you have a valid extension of time to file the return.

The gift tax return is due on April 15th following the year in which the gift is made. The due date for annual use tax returns for purchasers Forms ST-10 or ST-11 will remain April 15. The final return is due on or before April 15th of.

Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect on December 31 2000 exceeds 1000000. The new due date doesnt affect March 2021 monthly and quarterly returns. If the due date is a Saturday Sunday or legal holiday the due date is the next regular business day.

Massachusetts Estate Tax Return Rev. If the annual gross income of the estate is below 600 a return does not have to be filed. It does affect April 2021 monthly returns which are due May 30 2021 Exceptions.

The full amount of tax due for the estate tax return must generally be paid within nine months after the date of the decedents death. Here is the rate. Download Or Email M-706 More Fillable Forms Register and Subscribe Now.

This is the due date for the filing and payment of the estate tax return. Otherwise see April 19. The estate income tax return must be filed by April 15 2022 for a December 31 2021 year end or the 15th day of the fourth month after end of the fiscal year.

Note that it is also possible to get a six-month extension of time to file these returns although if there is a tax due an estimated tax will generally have to be paid within the original nine-month deadline Evaluating the Estate. Due on or before December 15 2022. If a return is required its due nine months after the date of death.

There are some deductions that can be made like funeral expenses administrative expenses claims. This is the due date for the filing and payment of the estate tax return. Up to 25 cash back Deadlines for Filing the Massachusetts Estate Tax Return.

If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. 1 The Final Taxes Form 1. As of 2016 if the executor pays at least 80 of the estate tax due before the deadline there will.

The due date for filing the estate tax returns is nine months from the decedents death. If the executor doesnt file a required estate tax return return within nine 9 months from the date of death or within an approved period of extension he or she will have to pay a penalty. 31 rows Generally the estate tax return is due nine months after the date of death.

If the due date is a Saturday Sunday or legal holiday the due date is.

The Affluent Investor Financial Advice To Grow And Protect Your Wealth Phil Demuth Financial Advice Financial Literacy Investors

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Massachusetts Estate And Gift Taxes Explained Wealth Management

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

A Guide To Estate Taxes Mass Gov

How Do State Estate And Inheritance Taxes Work Tax Policy Center

What Is Inheritance Tax And Who Pays It Credit Karma

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

How To Avoid Estate Taxes With Trusts

How Long Can The Irs Pursue The Estate Of Someone Who Is Deceased

A Guide To Estate Taxes Mass Gov

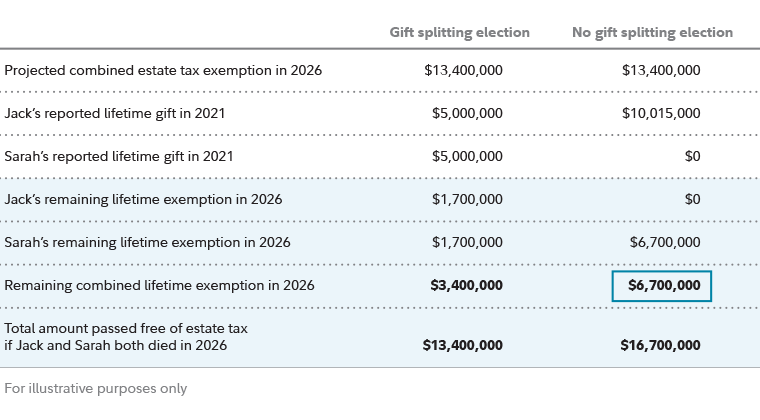

Estate Planning Strategies For Gift Splitting Fidelity

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Basic Tax Reporting For Decedents And Estates The Cpa Journal

Filing Tax Returns What Executors Need To Know Fifth Third Bank

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide